– The fund relies on a ‘bottom-up’ approach to select values that offer an attractive return.

– It seeks high-dividend and potential long-term dividend growth values.

Our commitments —

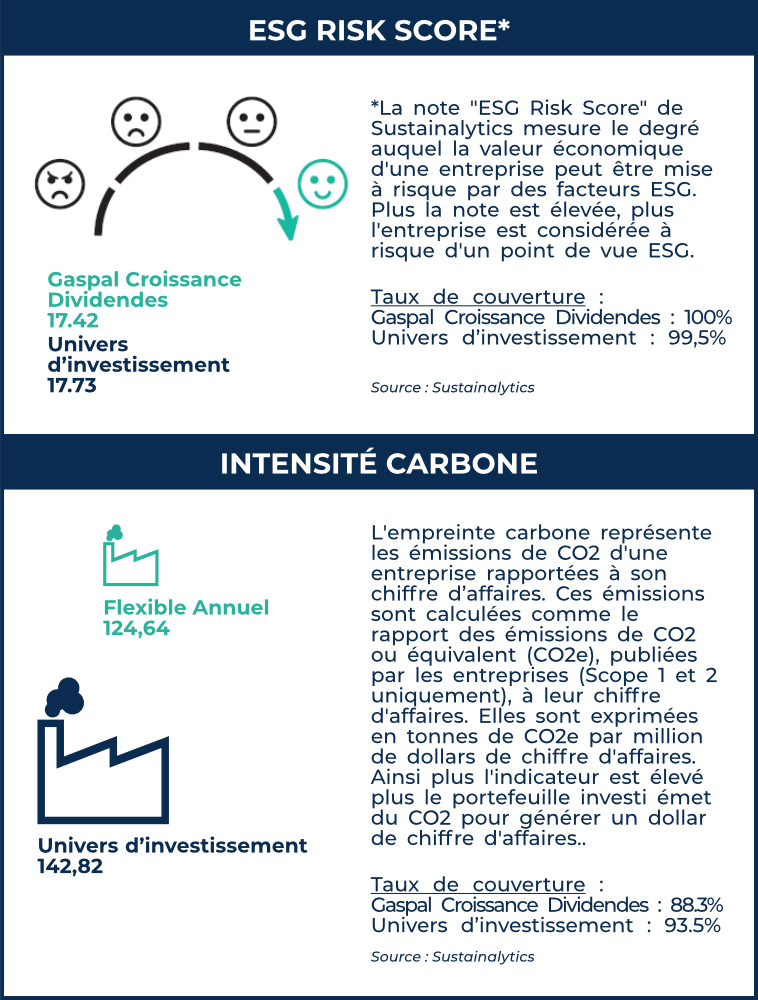

– A ‘Best in Class’ ISR approach, focusing on the highest-rated issuers from an extra-financial perspective within their industry.

– A ‘Best in Class’ ISR approach, focusing on the highest-rated issuers from an extra-financial perspective within their industry.

– A strict exclusion list: 0% exposure to fossil fuels, arms, and tobacco.

– A commitment-focused policy at the heart of our investments through individual initiatives or coalitions of investors.

Funds’ evolution —

Past performance is not necessarily indicative of future performance.

The information presented above does not constitute a contract or investment advice. The value of the investment may vary according to market fluctuations, and the investor may lose all or part of the capital invested, as UCIs are not capital guaranteed. Access to the products and services presented here may be subject to restrictions for certain persons or countries. Tax treatment depends on individual circumstances. Before subscribing, and for any further information on the characteristics, risks and fees of the UCI, investors are invited to read the regulatory documents available on the page of each UCI.

Management team —

Why should you chooseGaspal Croissance Dividendes? —

– Integration of a Best in Class ESG approach.

– Objective: a long-term return on investment superior to Eurozone equities with lower volatility.

– The fund prioritizes the sustainability and growth of the dividend over an immediate high yield, leading to the selection of values with a robust business model, quality management, and a solid balance sheet.

– Portfolio built around three segments, with weights varying based on market expectations.

Annual Performance —

Technical data —

Technical characteristics —

Reference indicator

Net dividends reinvested

Recommended minimum investment horizon

Quotation

Funds managers

SRI*

ISIN

Bloomberg

Valuation price

Custodian

Valuer

Type

Management fee incl. VAT

Administrative fee incl. VAT

Entrance fee incl. VAT

Exit fee incl. VAT

* SRI (Synthetic Risk & Reward Indicator, on a scale of 1 to 7): Level 1 = low risk & reward / Level 7 = high risk & potential for high reward.

Where and how to subscribe to the fund —

Through a wealth manager at Trusteam Finance — Contact the Wealth Management team directly (contact details available on this page) to benefit from personalised support. We will suggest the solution best suited to your needs.

Through your bank — You can subscribe by sending the ISIN code associated with the fund to your usual contact. The fund can then be deposited in a securities account, a PEA (if eligible), a life insurance policy or a PERP.

Through your independent financial advisor — Your independent financial advisor will help you select the fund from the Trusteam Finance range that best suits your asset management needs.

Downloadable documents —

Reports

Regulatory

Responsible Investment

Find our Monthly Fund Reports delivered to your inbox.